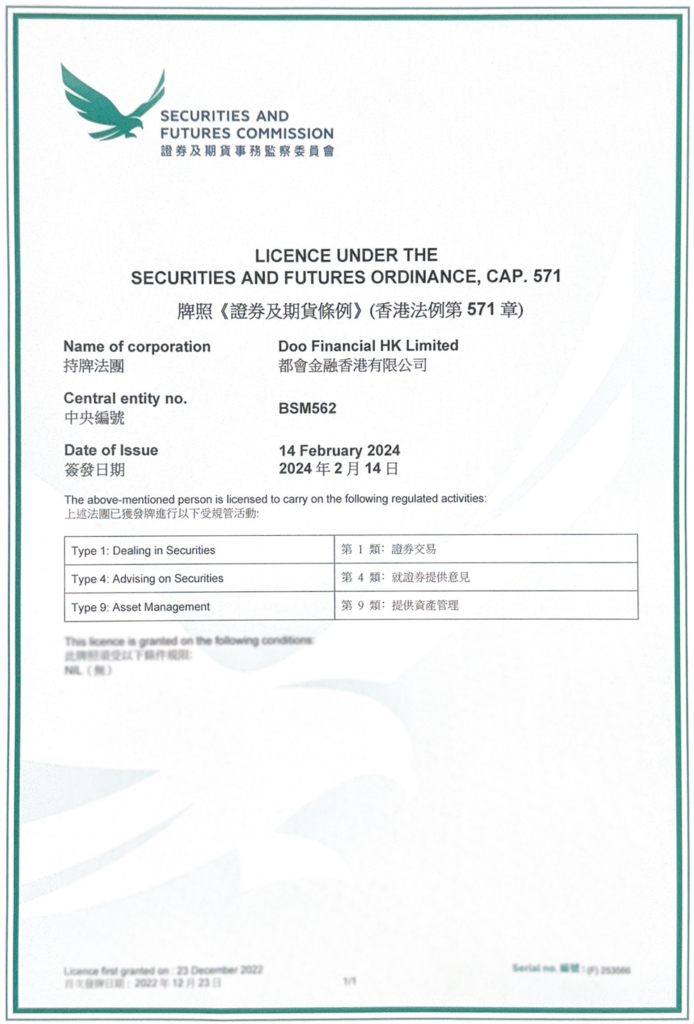

We are excited to announce a significant milestone for Doo Group’s subsidiary, Doo Financial HK Limited (Central Entity No.: BSM562), which has successfully secured the prestigious Type 1 (Dealing in Securities) License from the Hong Kong Securities and Futures Commission (HK SFC), providing more diverse financial services to our clients.

Hong Kong Securities and Futures Commission (HK SFC) Type 1 License: Dealing in Securities

The Hong Kong Securities and Futures Commission (HK SFC) is an independent statutory body overseeing the Hong Kong securities and futures market. The statutory body is dedicated to enhancing and maintaining the integrity and stability of the Hong Kong securities and futures market, protecting investors’ and businesses’ interests. According to Hong Kong regulation requirements, a company must obtain Type 1 license from the HKSFC to offer securities trading-related services in the region.

This license entails rigorous application requirements, evaluating aspects such as the company’s business model, financial standing, corporate governance, qualifications of upper-level management and employees, and overall company performances. Leveraging our commitment to high business compliance standards and the robust strength of our group, Doo Financial HK Limited has successfully acquired the HK SFC Type 1(Dealing in Securities) license. This approval authorizes us to offer clients a range of services, including:

(a) Execution of securities dealing transactions on behalf of clients;

(b) Distribution of securities such as unit trusts and mutual funds;

(c) Joint Bookrunner

(d) Placing & Underwriting

Diverse Development with Compliance Operations

Hong Kong has a comprehensive legal system and regulatory framework; it is one of the main financial centers in the world. It has provided vast opportunities for the development of financial activities. The Hong Kong market is pivotal for Doo Group, presenting diverse strategic and significant opportunities for the company.

The acquisition of this license, we are poised to expand our business sectors, providing investors with a broader spectrum of financial services, and facilitating the discovery of new investment opportunities.

Doo Financial HK Limited had previously obtained the HK SFC’s Type 4 (Advising on Securities) and Type 9 (Asset Management) licenses. This additional Type 1 (Dealing in Securities) license complements our service offerings, enabling us to provide securities trading, investment consultation, asset management, and other financial services under stringent regulatory oversight. Importantly, it reinforces our commitment to protecting the investment rights of our clients.

With the core value of “clients come first”, Doo Group has always placed our clients’ benefit as our priority. The obtainment of this license signifies Doo Group’s compliance strengths and demonstrates the continuous advancement of the group’s capacity.

Looking ahead, we remain dedicated to maintaining the highest standard of compliance in our operation, continuing to deliver professional financial services that empower our clients, to explore and capitalize on diverse investment opportunities!

About Doo Group

Doo Group, established in 2014 and headquartered in Singapore, is an international financial services group with FinTech as its core. Operating through 10 major business lines, including Brokerage, Wealth Management, Property, Payment & Exchange, FinTech, Financial Education, Healthcare, Consulting, Cloud, and Digital Marketing, Doo Group continually strengthens our financial ecosystem. We are dedicated to providing comprehensive financial services and innovative solutions to clients worldwide. Together, we embark on a journey to Explore α Better Future.

Currently, the entities within Doo Group, according to their location and products, are regulated by many of the top global financial regulators, including, but not limited to the United States Securities and Exchange Commission (US SEC) and the Financial Industry Regulatory Authority (US FINRA), the United States Financial Crimes Enforcement Network (US FinCEN), the United Kingdom Financial Conduct Authority (UK FCA), Financial Transactions and Reports Analysis Centre of Canada (CA FINTRAC), the Australian Securities & Investments Commission (ASIC), the Australian Transaction Reports and Analysis Centre (AUSTRAC), the Monetary Authority of Singapore (SG MAS), the Hong Kong Securities and Futures Commission (HK SFC), the Hong Kong Insurance Authority (HK Insurance Broker), the Hong Kong Companies Registry (HK Trust Company), the Hong Kong Customs and Excise Department (HK Money Service Operator), the Hong Kong Estate Agents Authority (HK EAA), the Dubai Real Estate Regulatory Agency (AE RERA), the Dubai’s Department of Economy and Tourism (AE PSP), the Seychelles Financial Services Authority (SC FSA), the Malaysia Labuan Financial Services Authority (MY Labuan FSA), Mauritius Financial Services Commission (MU FSC), and the Vanuatu Financial Services Commission (VU FSC). Doo Group has entities operating in various global locations, including Dallas, London, Singapore, Hong Kong, Sydney, Cyprus, Dubai, Kuala Lumpur, Thailand, South Africa, Egypt, Seychelles, Mauritius, Vanuatu, as well as other regions.

For enquiries and further information, please contact us:

Official Website: doo.com

Hong Kong: + 852 2632 9557

Singapore: +65 6011 1736

Email: [email protected]

Forward-looking Statement

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Group will be generally assumed as forward-looking statements.

Doo Group has provided these forward-looking statements based on all current information available to Doo Group and Doo Group’s current expectations, assumptions, estimates, and projections. While Doo Group believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Group’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Group does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Group is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

This article is for information purposes only and should not be construed as investment advice. Doo Group does not make any representations or warranties regarding the accuracy or completeness of the information provided.

Please make sure you read and fully understand the risks of the products or services described in this article before engaging any transaction with us. You should seek independent professional advice if you do not understand the risks disclosed herein.

Disclaimer

This information is addressed to the general public for informational purposes only and should not be taken as investment or professional advice, recommendation, offer, or solicitation to buy or sell any products mentioned here. The information displayed here has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a product shall not be taken as a reliable indicator of its future results. Doo Group makes no representations or warranties regarding the information displayed here and shall not be liable for any direct or indirect loss or damages incurred by the reader as a result of using the information provided.

An Entity Under Doo Financial Successfully Registered As A Dealer In Precious Metals and Stones Under Hong Kong Customs and Excise Department

An Entity Under Doo Financial Successfully Registered As A Dealer In Precious Metals and Stones Under Hong Kong Customs and Excise Department